So I hear real estate investors and entrepreneurs ALL THE TIME talk about residual and passive income. And, they usually use these words interchangeably in the same sentence.

The problem with that is that they are NOT the same thing.

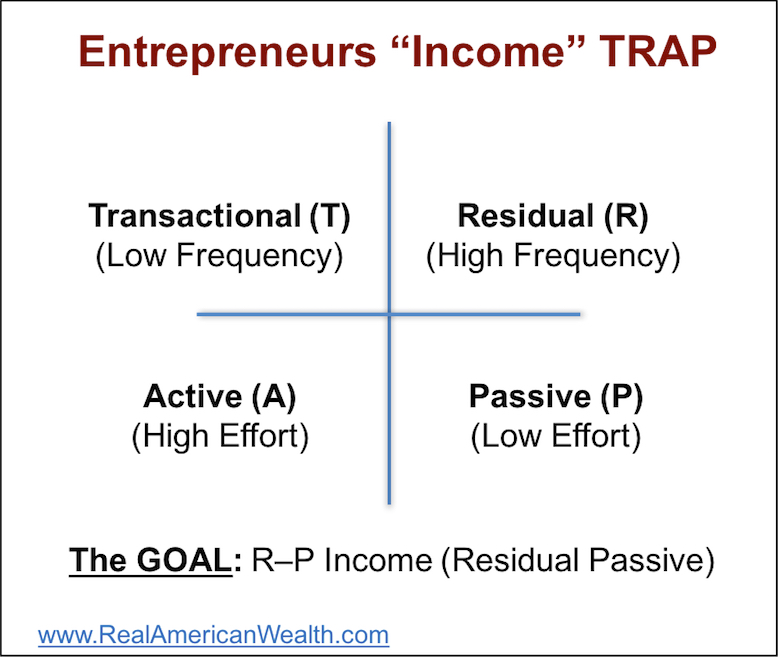

This misunderstanding leads to something I call this the Entrepreneurs TRAP (you’ll see why below). And, for the ease of explanation, I’ve broken my explanation into 4 quadrants.

The top 2 quadrants represent Transactional and Residual and the bottom two quadrants represent Active and Passive.

Take a look:

I call this the TRAP because most entrepreneurs, investors and people in general, simply don’t understand the practical differences between the quadrants. And, by not understanding, most people end up making business or investment decisions that don’t end up “performing” the way they expected.

Let me explain:

Most people expect Residual income to be Passive. But, the reality is, it may not be. (keep reading)

Transactional and Residual Income (which are the top quadrants in the image above), speak to the frequency of getting paid. Transactional income is a low frequency and in most cases there’s no “frequency” at all, it’s just a one and done thing.

Residual income on the other hand is a higher frequency, i.e you get paid more than once for your initial effort. Residual income is a series of payments that go for a period of time, or that go on into perpetuity?

The thing to understand it this, just because the income is residual doesn’t mean you don’t have to keep working after the initial effort of creating the income stream is done.

Rentals and landlording are a perfect example to demonstrate this. The income stream of a rental is Residual, but the effort required to be a good landlord (even if you’re just managing the manager) doesn’t go away.

Now, when we look at the bottom of the quadrants, we see Active and Passive Income. These speak to the effort it takes you to actually get paid. Active income is High Effort (you have to work hard) and Passive Income is Low Effort. Passive income is money that comes in whether you’re working or not.

I’ll share a good example of a passive income stream below.

But first, did you notice the difference?

Residual income is the frequency that you get paid. Passive income is the effort you have to put in to actually get paid.

So, the goal, as you can now see is not to just create Residual Income…but rather, the goal is to create Residual-Passive Income, i.e. a combination of a high frequency of incoming payments and from a low amount of effort.

That’s the difference between the two.

In your business and when making investment decisions, understanding this difference and asking questions about “frequency” and “effort”, you’ll make choices that lead you your actual goal.

In our business, a great example of R-P income is Private Lending. For years, we’ve been an active real estate investing company and we work with operator’s from around the country.

The private lenders we work with look at the their options and, given their life choices, other business/job responsibilities and limited knowledge or access to opportunities, wisely choose to simply step into a residual-passive role.

By lending funds (the money always goes straight to the title company, never to the real estate investor/operator) that get secured by real estate to an experienced investor/operator with a track record of doing the “active” work successfully, it becomes a truly win-win (residual-passive) relationship.

Keep an eye out for a post where I break down the benefits of private lending and how you could use it to create a truly R-P income for yourself using personal cash or IRA/401K retirement funds.

You’ll love it.